Tax return process

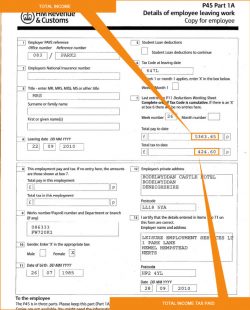

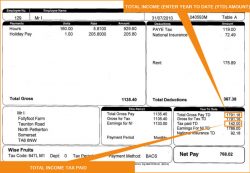

If you have worked in Great Britain during the last five years, you can file for a tax return. It is a simple procedure with RT Tax: register, gather the necessary documents, provide them to us, and we shall take care of the rest!

Clients from Great Britain usually get 1017 GBP returned on average.